Choosing a private health plan isn’t only about the benefits. The strength of the medical network behind your plan can often determine things like:

- How quickly you receive treatment

- Your out-of-pocket costs

- Ease of Access

- Your overall experience

These are all vital factors in any healthcare journey that become even more critical when you're living abroad and navigating an unfamiliar environment.

What is a medical network?

A medical network is a group of expertly curated healthcare providers that an insurance company or Third-Party Administrator (TPA) have contractually partnered with, and will typically include:

- Hospitals

- Clinics

- Day-patient centres

- Diagnostic and lab facilities

- GP clinics and other primary care or healthcare facilities

These partnerships between healthcare providers and medical insurers typically set out:

- Quality and credentialing standards, like clinical governance.

- Commercial terms and negotiated rates for treatments and consultations.

- Administrative processes like direct billing, pre-authorisation, and how claims work.

For those with private health insurance, a medical network makes it easier to use your health plan to find and access reliable care and treatment.

8 reasons your medical network matters

1. Faster access to quality care

Your insurer has already done the due diligence on the quality and capabilities of the providers in their network, meaning you can have confidence in attending any facility to get the attention you need. This is particularly vital when you’re unwell and unfamiliar with the local healthcare system, especially if you’re living in a country where the quality of the facilities can vary widely.

2. Predictable and often lower out-of-pocket costs

The rates your insurer negotiates with network providers protect you from inflated charges and ensure you almost always know what your out-of-pocket expenses, if any, will be before you start treatment. In contrast, out-of-network providers may charge you more than local market norms, and reimbursement caps may result in higher out-of-pocket costs.

3. Administrative ease via direct billing

Direct billing removes the burden of paying sometimes significant sums upfront then waiting for reimbursement, as well as ensuring you avoid paperwork and currency conversion issues, all crucial if you’re in unfamiliar surroundings or facing a complex treatment plan.

4. Fewer claim delays and quicker reimbursements

Claims flow more smoothly when insurers and medical providers have alignment on benefits and medical necessity criteria, and when providers know what to submit for swift claim processing.

5. Better coordinated and continuous care

In addition to the integrated pathways we mentioned earlier, medical networks also often include second medical opinion services and case management frameworks for complex diagnoses or treatment plans. This coordination improves communication between providers and enhances continuity of care, making the journey from diagnosis and specialist consultations through to care, rehabilitation and recovery as smooth as possible.

6. Enhanced patient safety

Your insurer will conduct ongoing provider credential checks and outcome monitoring, ensuring that your network provides the safest and most comprehensive level of care.

7. Global mobility without the guesswork

Whether you’re an expat based in one location or a globally mobile individual, a broad international network makes it easy for you to access reliable care in multiple countries under consistent rules and processes. This allows you to accept projects in new markets or travel regionally with peace of mind for you and your family.

8. Digital convenience

Leading insurers’ medical networks these days are managed digitally, meaning you can typically do the following, and often much more, directly from your smartphone:

- Check your network and provider directory

- Get directions to medical facilities

- Verify your cover with a digital membership card upon arrival at a network facility

- Request pre-authorisation and check the status of guarantees of payment and claims

- Access telemedicine services

How a medical network works in practice

When you require care, your medical network turns your health plan into a treatment pathway, so you can focus on getting better rather than worrying about paperwork.

In general, the purpose of a medical network is to ensure you can get the treatment you need, when you need it, with as little stress or uncertainty as possible. In the long term, a medical network can also provide the added benefit of controlling costs, which can support more stable premiums over time.

From appointment to claim in four steps

Here’s how it typically works:

- Find a medical provider. Use your insurer’s online directory or assistance team to find an in-network facility. Confirm whether direct billing is available and if pre-authorisation is needed.

- Get pre-authorisation if required. Your insurer will review clinical notes from your treating doctor and estimated costs, and, if approved, issue a guarantee of payment directly to the provider, confirming they will cover the eligible costs.

- Attend your appointment or admission. You'll need to present your membership details and, depending on your location, possibly a photo ID. Pay any applicable co-pay or deductible.

- Submit, track, and close your claim if direct billing wasn’t available. Upload all the required claim documents so your insurer can process your claim and reimburse you efficiently.

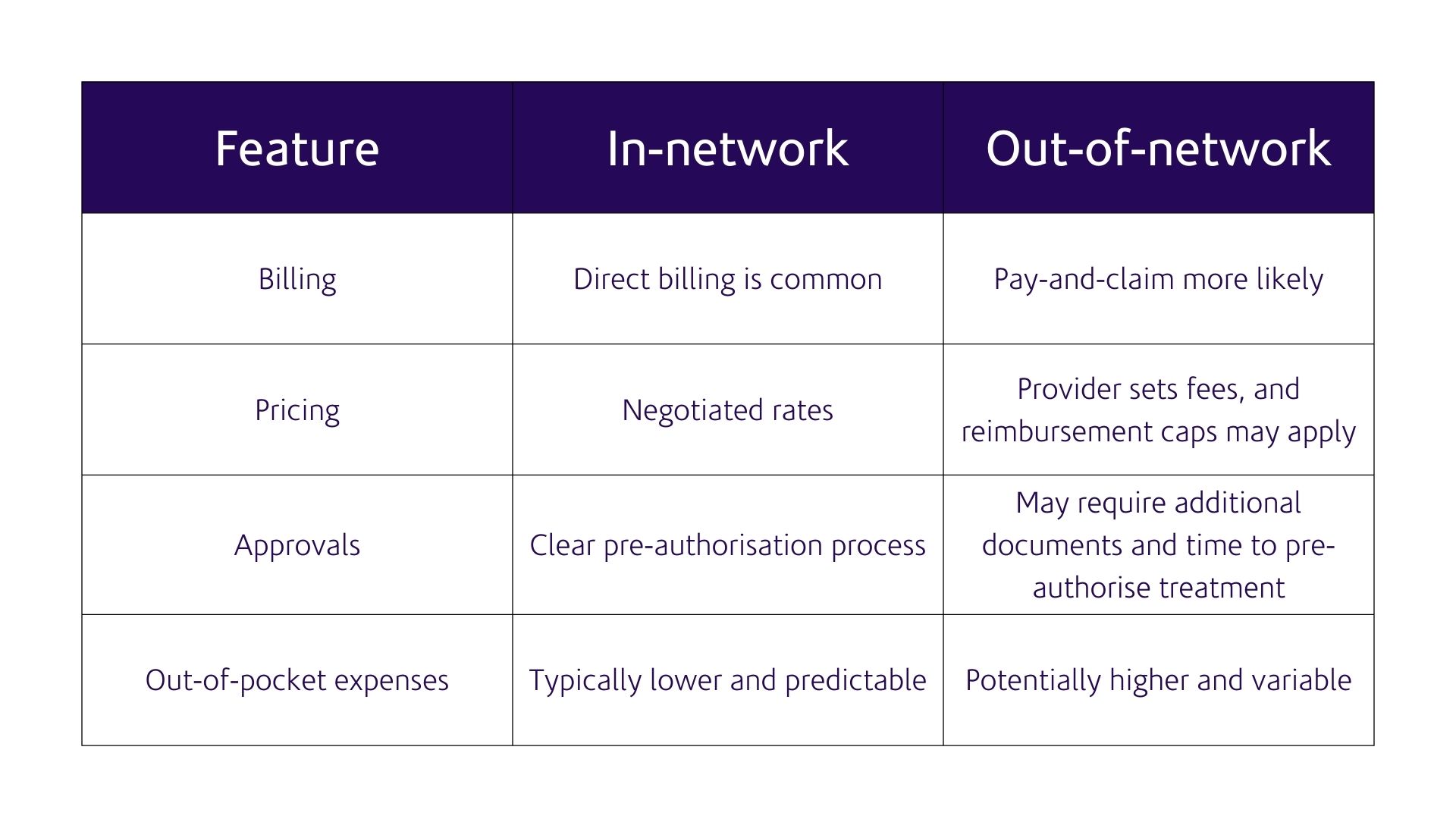

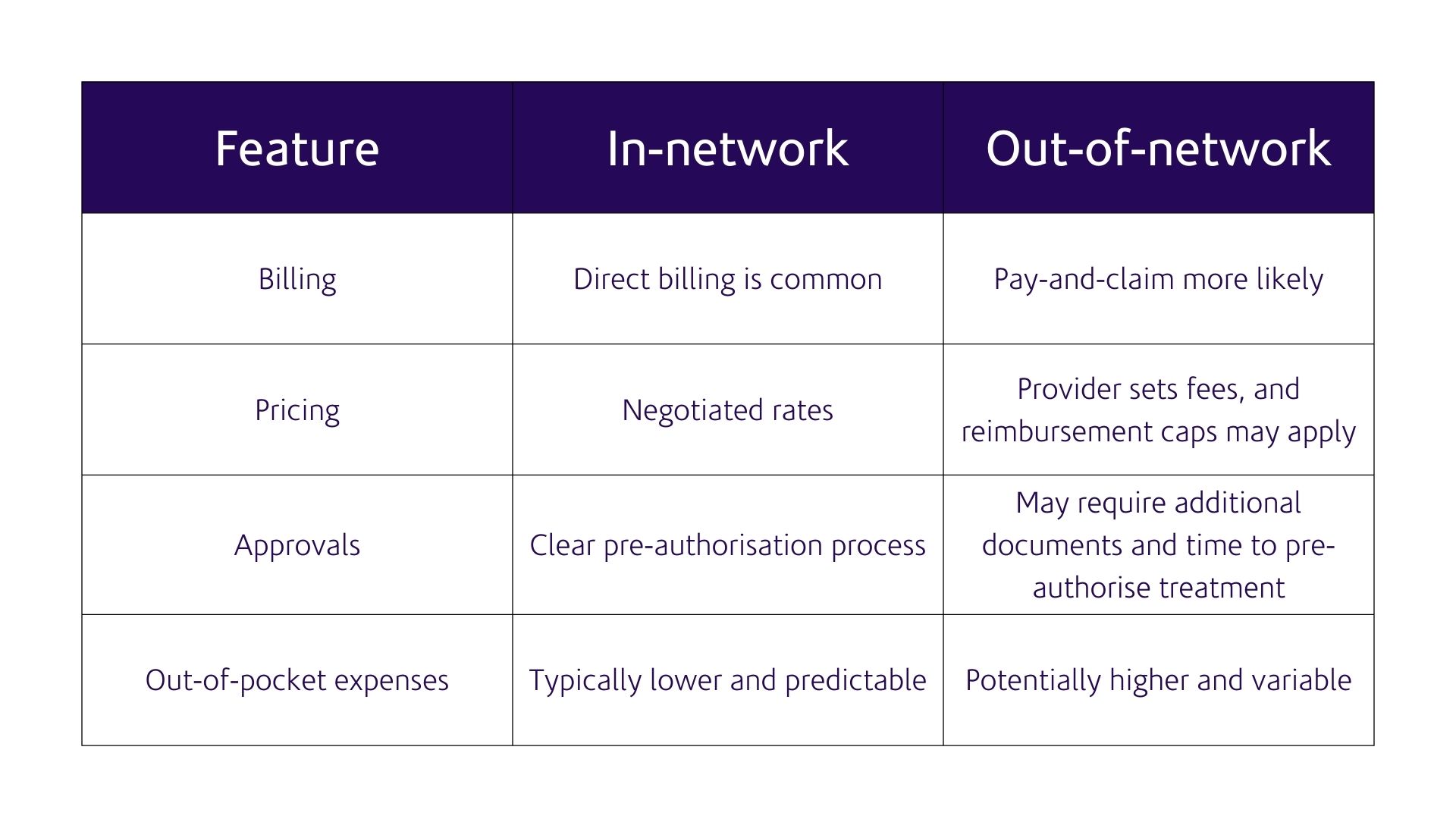

Understanding in-network vs. out-of-network options

Depending on your health plan, you may have a range of options when it comes to electing for in-network or out-of-network care.

- In-network care is delivered by providers who have an agreement with your health insurer, as we’ve described so far. You will often be able to access direct billing facilities and benefit from predictable pricing and quick pre-authorisation and claim approvals.

- Out-of-network care is any care or treatment you receive from providers who do not have a direct agreement with your insurer. Coverage may still apply depending on your plan and if a medical facility accepts patients with your insurance. You will most likely need to pay for your treatment upfront and then submit a claim for reimbursement, and you may face higher out-of-pocket costs if the provider's charges exceed your insurer's reimbursement limits.

Direct billing

Direct billing – sometimes called cashless treatment – means the medical provider invoices your insurer directly for eligible services. To access direct billing facilities, you will typically need to present your membership card and pay any applicable deductible (excess) or co-pay/co-insurance. Direct billing can be particularly useful when you need unexpected care, although you may still need to get pre-authorisation for some treatments.

Note that direct billing applies only to eligible benefits, treatments and conditions. If a service isn’t covered for direct billing, the provider may ask you to pay at the point of care. You’ll still be able to submit a claim, although check if you require pre-authorisation before undergoing any treatment you pay for to ensure you won’t be paying out of pocket. You will also remain responsible for paying any deductible, co-pay / co-insurance, or for any treatment costs that exceed your plan limits.

Pre-authorisation

Planned hospital admissions, high-cost imaging or diagnostics, and specific treatments may require pre-authorisation, which is when your insurer will assess whether the care and treatment you're seeking is medically necessary and eligible under your plan. Pre-authorisation helps you avoid surprise medical bills, while your insurer can also give providers certainty by providing guarantees of payment before you begin treatment.

Learn more: What is pre-authorisation?

Referrals and care pathways

Some medical networks use specific pathways. For example, your care pathway may involve consulting a general practitioner first or using a specific diagnostic centre before starting treatment. Such pathways can help you receive the treatment you require more efficiently, enable better coordination of your care, and keep costs predictable and stable.

Emergency support and evacuations

Robust medical networks provide you with 24/7 assistance teams who can direct you to the most suitable facility should you need care or treatment. If appropriate care isn't available locally, your health plan may include medical evacuation, allowing your medical network to arrange transportation to a suitable facility elsewhere.

How to use your medical network effectively

You'll only appreciate and unlock the value of your medical network if you know how to utilise it effectively. Ensure you can use your medical network effectively by:

- Saving helpline and assistance numbers in your smartphone.

- Understanding when pre-authorisation is necessary and the specific procedures for different facilities. For example, some facilities may only see you if you have booked an appointment in advance.

- Downloading your digital membership card to your smartphone wallet.

- Always carrying anything else you may need with you to verify your plan or identity, such as photo ID.

- Knowing your plan benefits and limits, including your deductible, any co-pay arrangements, waiting periods, and things like standard policy exclusions, session limits for mental health and physiotherapy, so you avoid surprise claim rejections and unexpected out-of-pocket costs.

- Visiting primary care facilities in the first instance whenever possible for non-urgent attention; they’ll be able to refer you within the network and put you on an appropriate treatment pathway depending on the care you require.

What to expect if you opt for out-of-network care

Even with access to a comprehensive medical network, there may be times when seeing an out-of-network provider is necessary, such as if you need to visit a unique specialist or your family doctor, or are in a remote location a significant distance away from your nearest in-network facility.

If you elect for out-of-network care or attend an out-of-network facility out of necessity, you should consider the following:

- Check with your insurer to see if there is a suitable in-network option; if not, your insurer may be able to arrange a single-case agreement, allowing you to obtain a diagnosis or undergo treatment with an out-of-network provider. Otherwise, reimbursement is typically capped at standard local market rates, and you will need to pay for your treatment upfront and then claim.

- Coverage may still apply for out-of-network care depending on your health plan, but your insurer may cap what they'll pay. If the medical provider charges more, you will be responsible for paying the difference.

- Pay and claim is common, so even if you have a single-case agreement or pre-authorisation, you'll still need to pay for your treatment and then submit a claim. Be aware that there is a risk that you may pay for treatment upfront, only for the subsequent claim to be rejected by your insurer if it doesn't meet your plan criteria.

- Know what to do in an emergency. In an emergency, your priority should always be to seek treatment at the nearest suitable medical facility. Get stabilised first, then contact your insurer as soon as possible. They can coordinate coverage and arrange a transfer to an in-network facility if necessary. Ensure someone you trust also has your coverage details in case you are unable to make the call yourself.

How Now Health International supports you to use our medical networks

Our private health plans and medical network are designed to provide our members with ease of use and access to the best possible levels of care, offering:

- A comprehensive provider network, with direct billing available across many key locations. You can explore our provider network through our Find a Medical Provider Tool.

- 24/7 service support and pre-authorisation issuance capability, ensuring our members can find suitable in-network care is seamlessly coordinated and arranged – even across multiple time zones.

- Digital tools and features, including our Find a Medical Provider tool, which integrates with Google Maps for easy navigation to facilities, as well as our Secure Online Portfolio, from which members can manage claims, seek pre-authorisation, and much more.

- Coordination of care, particularly in complex medical cases, to support members’ journey from diagnosis to treatment and recovery. Read a real-life story of how we supported one of our members on their journey from diagnosis to recovery.

Making the most of your medical network

Beyond your plan benefits and policy features, your medical network is the backbone of your insurance plan. A strong medical network helps you access quality care efficiently, controls both your premium and your out-of-pocket costs through negotiated rates, simplifies how you use your plan and seek treatment with direct billing, and supports you through coordinated pathways and treatment plans.

When choosing an international health insurance plan, pay close attention to the usability of your medical network; it’s the critical factor that transforms your insurance plan from a document into tangible, world-class healthcare when you and your family need it most.

Note that health insurance benefits, limits and processes may vary by plan and sometimes by region. Always refer to your certificate of insurance so you fully understand how your private health plan works for you.

Discover all our private health insurance plans.